DỊCH VỤ BACKLINK BÁO - Mua BACKLINK HIỆU QUẢ TOP #1

| ✅ Backlink Báo | 💖 79 Báo Dofollow |

| ✅ Chỉ số Báo | 💖 UR, DR cao |

| ✅ Số lượng Backlink lớn | 💖 > 1000 Backlink |

| ✅ Thời gian triển khai | 💖 3 – 5 ngày |

| ✅ Ưu Đãi | 💖Tặng Pr báo |

NỘI DUNG BÀI VIẾT

Mua backlink báo cho lĩnh vực nào?

Backlink báo có thể SEO cho tất cả lĩnh vực: Y tế sức khỏe, giáo dục, thời trang, thẩm mỹ, spa, vé máy bay, du lịch, công nghệ, luật, ô tô, tiệc cưới, giải trí, bán lẻ, đồ gia dụng, điện thoại… đều vô cùng hiệu quả.

Y tế, sức khỏe

Nội thất

Lượng tìm kiếm của nội thất rất lớn hàng tháng. Cuộc chạy đua lên TOP của lĩnh vực này được đầu tư khá nhiều nên bạn sẽ thực sự khó khăn để vượt mặt đối thủ. Backlink Báo số lượng lớn sẽ giúp bạn tạo tín hiệu nhanh chóng.

Bất động sản

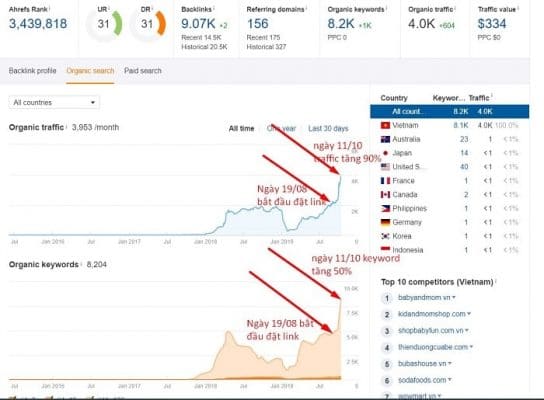

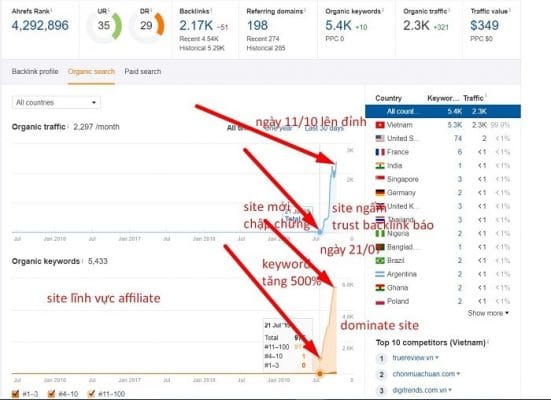

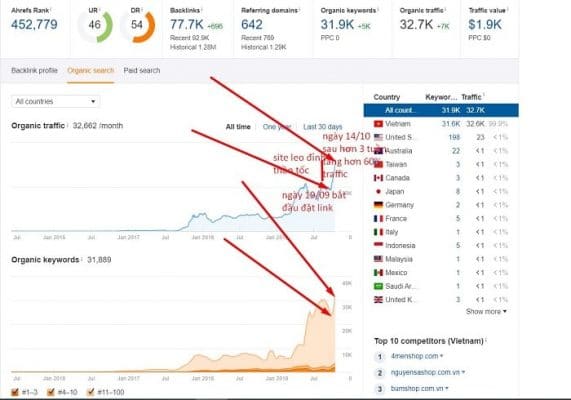

Đây là lĩnh vực khá khó nhằn trong seo. Sau khi Google update thuật toán thì để SEO lĩnh vực sức khỏe cần đáp ứng được độ tin cậy. Backlink báo là một trong những backlink nhận được độ uy tín từ google và đồng thời mình đã test cho dự án thực tế và cho hiệu quả tốt

Công nghệ

Cùng với sự phát triển của xã hội hiện đại, các ngành công nghệ được săn đón và yêu thích. Mình đã test backlink báo cho rất nhiều dự án và cho hiệu quả rất tốt. Bạn có thể thử nghiệm với gói 3 tháng nếu còn băn khoăn hiệu quả.

Quy trình đặt backlink báo

Vị trí đặt backlink báo

Backlink đặt tại sidebar của các báo trong bài viết của chủ đề bạn đang SEO. Khách hàng có thể lựa chọn các bài viết để đặt backlink hoặc dichvubacklink.com.vn sẽ lựa chọn theo chủ đề bạn cung cấp.

Cần bao nhiêu backlink báo để lên TOP

Website bạn càng lớn, có nhiều nội dung, càng lâu năm thì số lượng backlink sẽ càng lớn. Lưu ý để đặt backlink báo hiệu quả thì bên mình sẽ xem xét site và tư vấn SEO cho bạn.

Cách kiểm soát BACKLINK như thế nào?

Sau khi BACKLINK BÁO được hoàn thì thì dichvubacklink.com.vn sẽ gửi Fiel báo cáo đầy đủ nhất để kiểm soát vị trí và số lượng backlink. Trong quá trình sử dụng nếu có bất kì lỗi như link hỏng, gãy thì sẽ được thay bù lại đúng số lượng link như cam kết ban đầu.

Bao lâu sau đặt backlink thì có hiệu quả?

Hiệu quả sau 3 -5 ngày đặt Backlink Báo: Các chỉ số như UR, DR sẽ tăng ngay. Về thời gian lên TOP của từ khóa sẽ phụ thuộc vào chất lượng website, tối ưu onpage. Backlink sẽ cần được bổ sung và đa dạng giữa các loại như Guest Post, Social để hiệu quả lên TOP tốt hơn.

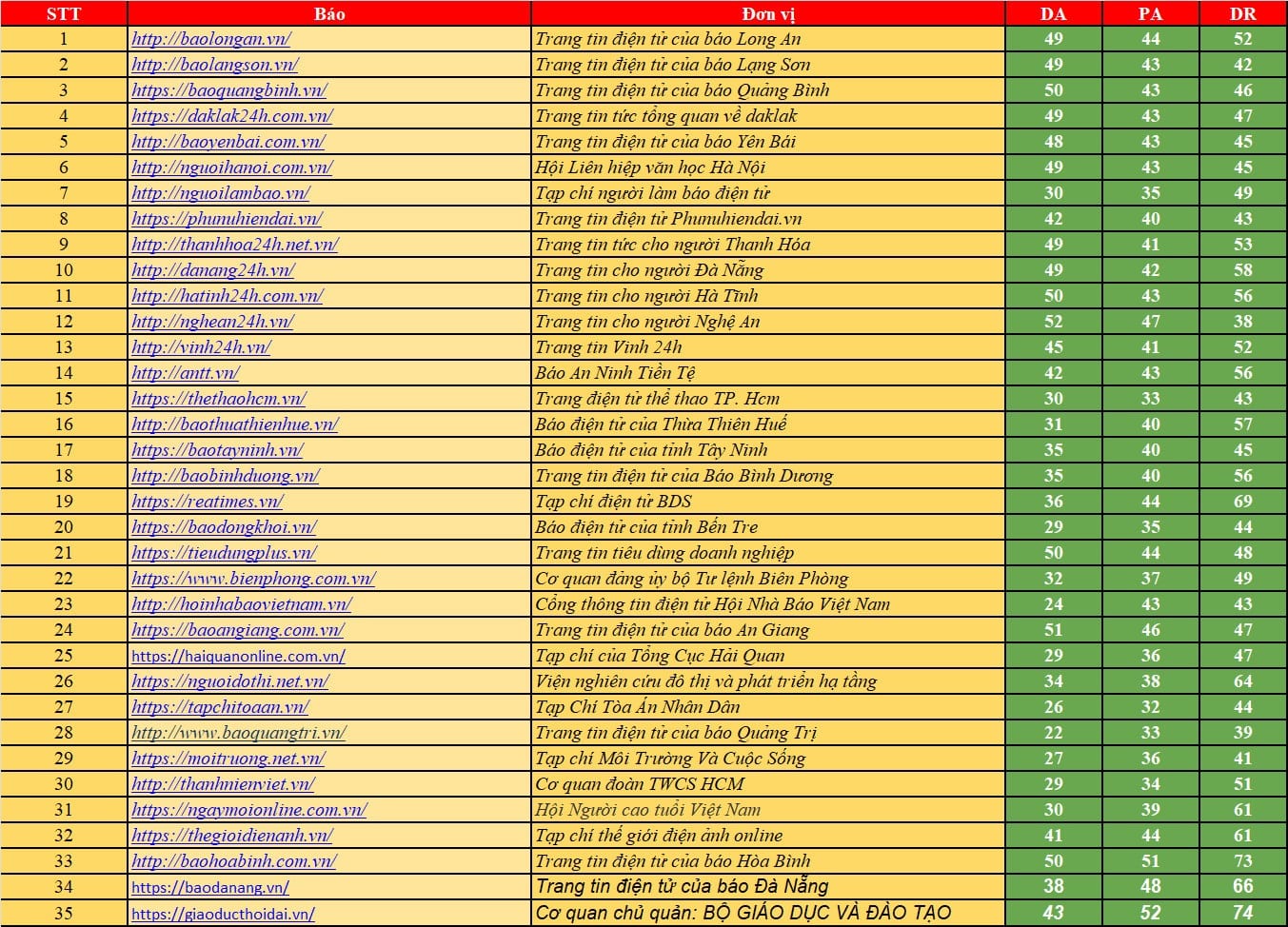

DANH SÁCH BÁO BACKLINK DOFOLLOW

Bảng báo giá Backlink Báo

GÓI BASIC

-

300 BACKLINK BÁO

-

Link trên 10 domain báo lớn

-

THỜI GIAN: 1 NĂM

-

Link trên bài báo cùng chủ đề

-

Tặng GP hoặc bài Pr trên báo

-

Hỗ trợ khai báo schema ( FAQ, social, author )

-

Tư vấn hỗ trợ SEO

-

Thời gian triển khai: 5 -7 ngày

GÓI GOLDEN

-

500 BACKLINK BÁO

-

Link trên 15 domain báo lớn

-

THỜI GIAN: 1 NĂM

-

Link trên bài báo cùng chủ đề

-

Tặng GP hoặc bài Pr trên báo

-

Hỗ trợ khai báo schema ( FAQ, social, author )

-

Tư vấn hỗ trợ SEO

-

Thời gian triển khai 5 -7 ngày

GÓI DIAMOND

-

1000 BACKLINK BÁO

-

Link trên 20 domain báo lớn

-

THỜI GIAN: 1 NĂM

-

Tặng thêm 1 Guest Post

-

Link trên bài báo cùng chủ đề

-

Hỗ trợ khai báo schema (FAQ, social, author)

-

Tư vấn hỗ trợ SEO

-

Thời gian triển khai 5 -7 ngày

GÓI VIP

-

1500 BACKLINK BÁO

-

Link trên 25 domain báo lớn

-

THỜI GIAN: 1 NĂM

-

TẶNG 1 BÀI PR BÁO LỚN

-

Link trên bài báo cùng chủ đề

-

Hỗ trợ khai báo schema (FAQ, social, author)

-

Tư vấn hỗ trợ SEO

-

Thời gian triển khai: 10 ngày

GÓI SUPER VIP

-

1500 BACKLINK BÁO

-

Link trên 33 domain báo lớn

-

THỜI GIAN: 1 NĂM

-

TẶNG 1 BÀI PR BÁO LỚN

-

Link trên bài báo cùng chủ đề

-

Hỗ trợ khai báo schema (FAQ, social, author)

-

Tư vấn hỗ trợ SEO

-

Thời gian triển khai: 10 ngày

- Lưu ý: Bảng giá của chúng tôi có thể thay đổi theo thời gian mà chưa kịp cập nhật trên trang web. Vì vậy để được báo giá chính xác nhất quý khách hãy liên hệ ngay tới HOTLINE: 0964.592.762

- Hiện tại đang có Khuyến mại tặng bài PR

- Khuyến mại tặng Backlink Báo

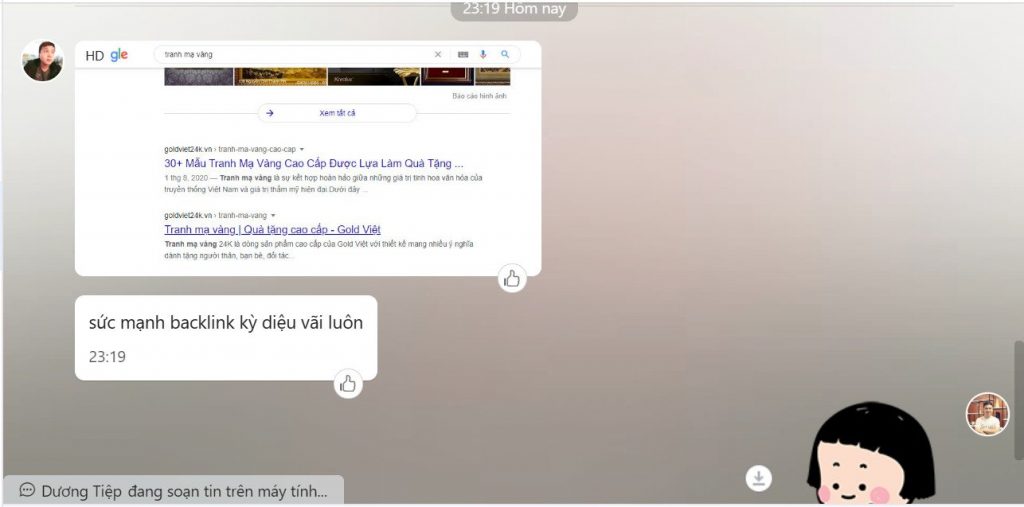

Hiệu quả khi dùng Backlink Báo

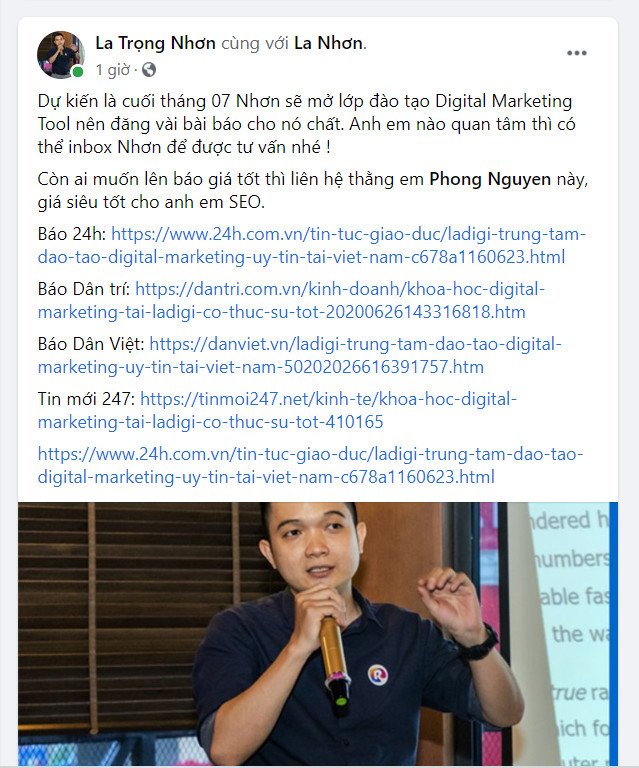

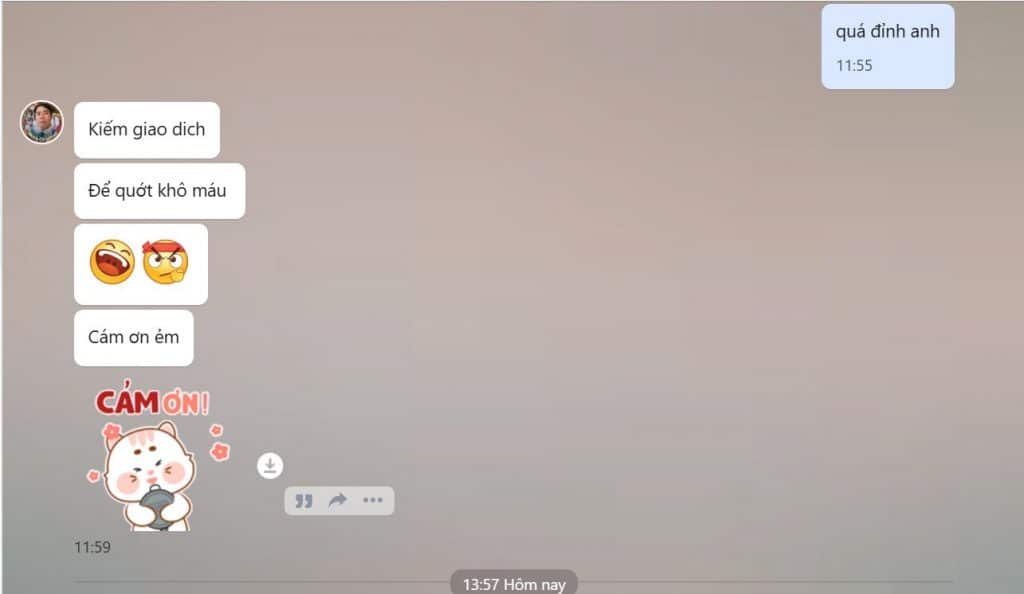

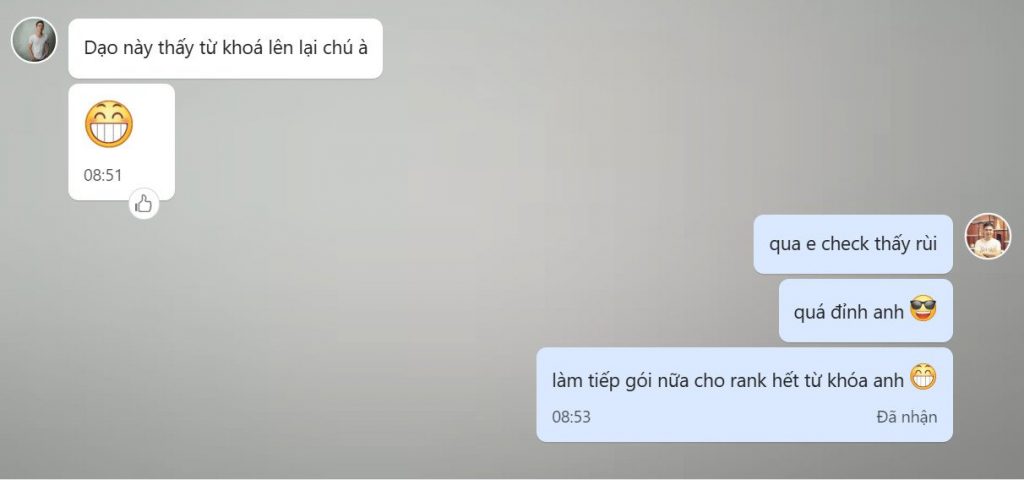

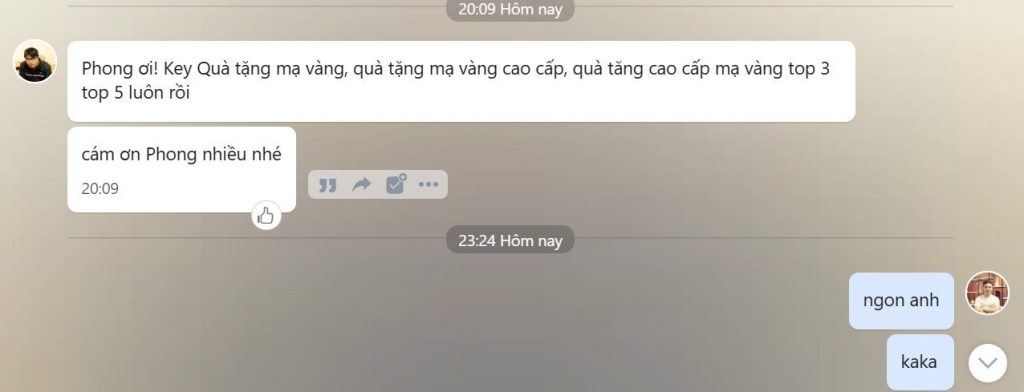

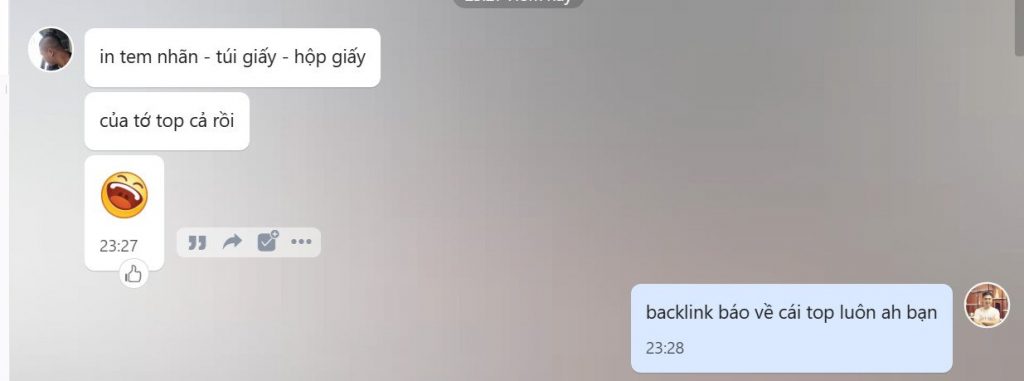

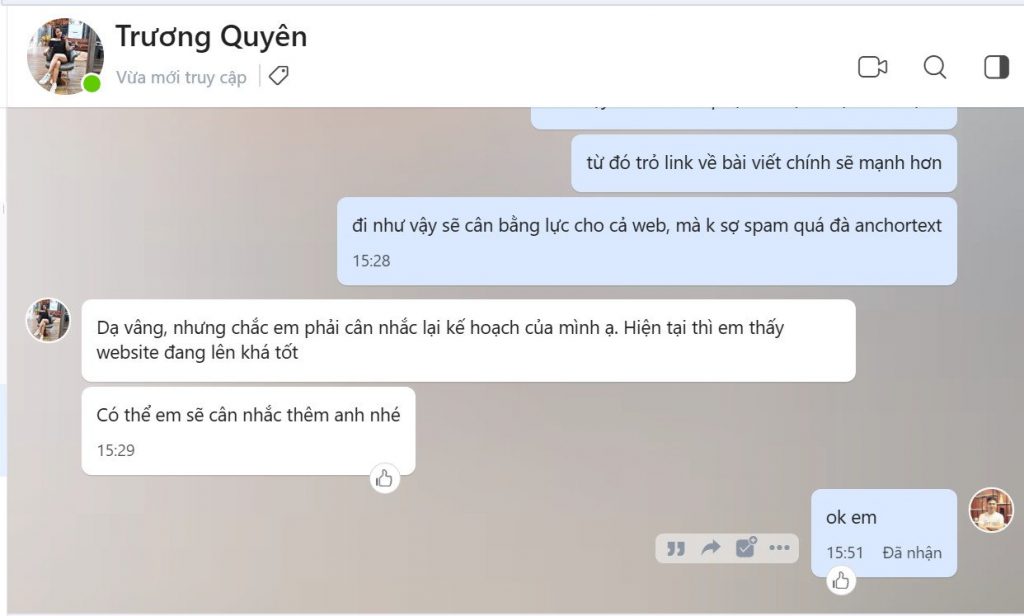

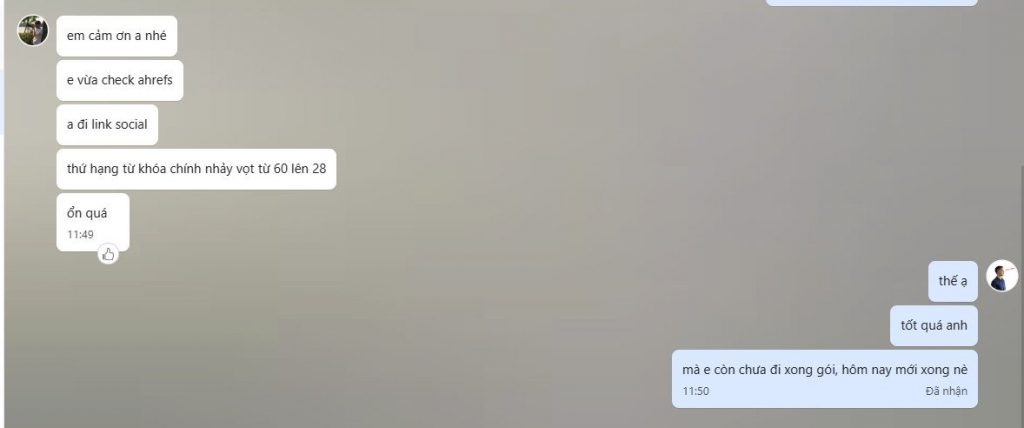

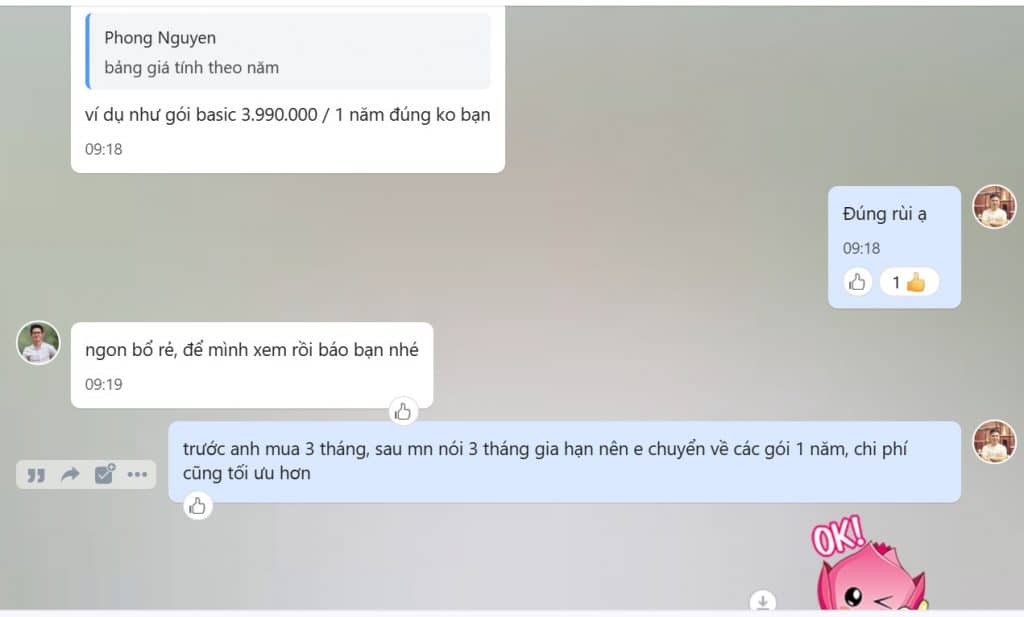

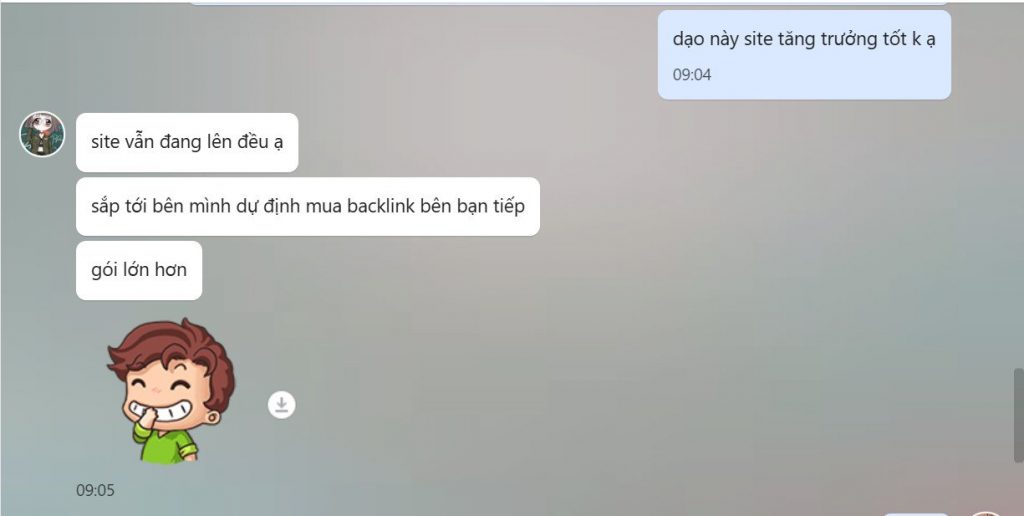

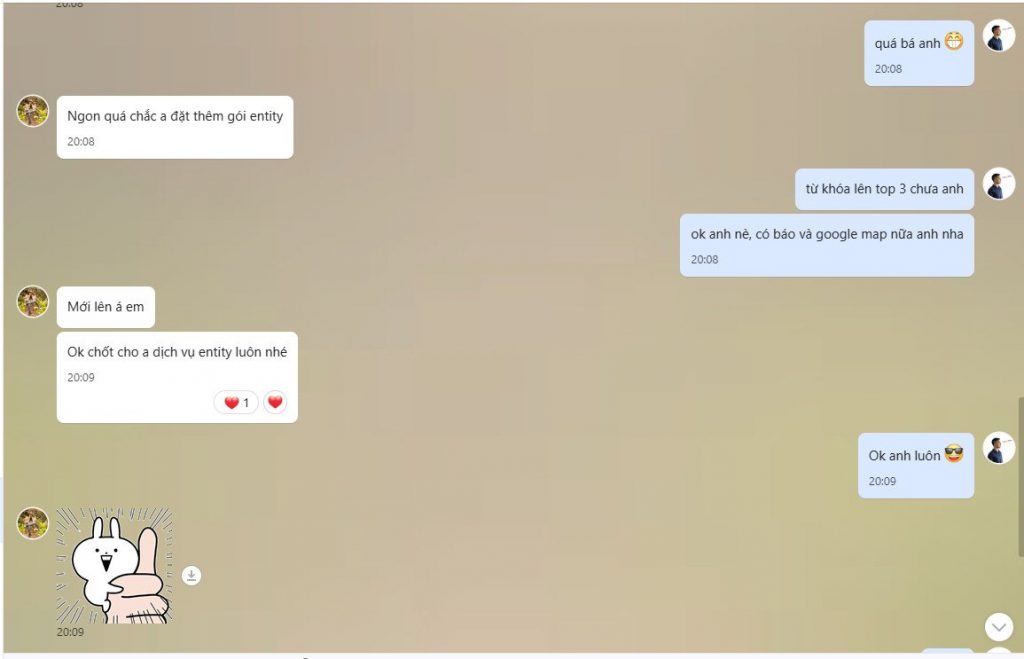

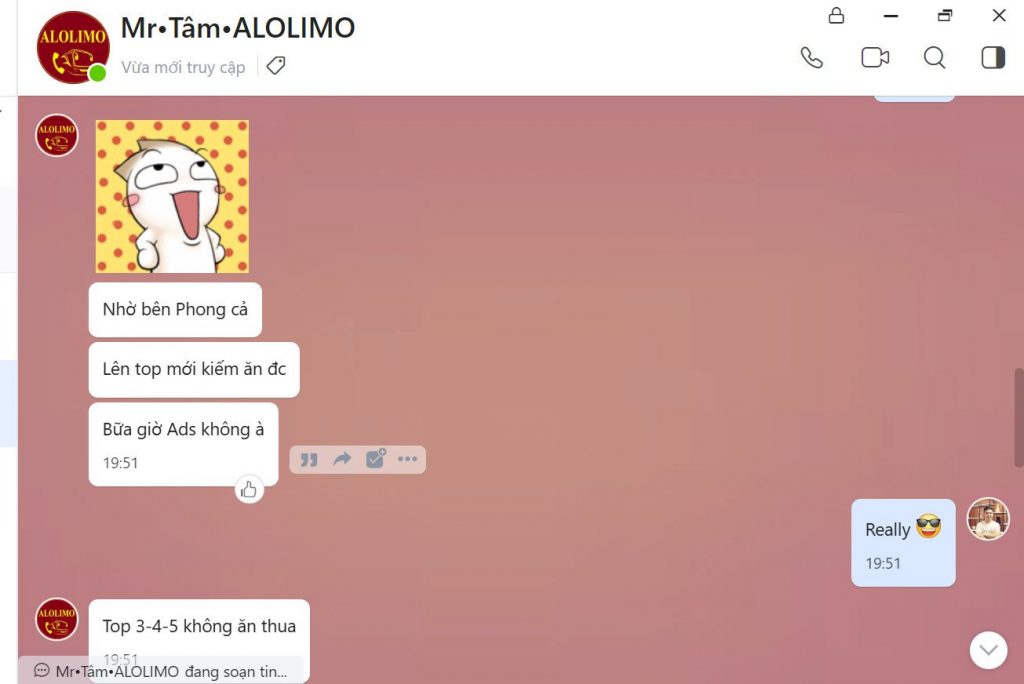

Khách hàng nói gì về chúng tôi?

Có nên mua backlink Báo Không?

Câu hỏi thường gặp khi đi backlink báo

Backlink báo chí là backlink chất lượng trên thị trường hiện nay. Đây là những website có DA, PA lơn, traffic hàng triệu mỗi tháng. Backlink Dofollow số lượng lớn.

Việc khuyến mãi backlink báo sẽ được tiến hành tùy theo từng giai đoạn và chính sách của công ty chúng tôi: Tặng backlink báo miễn phí và bài PR. Để nhận được thông tin chi tiết, vui lòng liên hệ theo số điện thoại: 0964.592.762

Tối ưu Content/Onpage/Offpage sẽ phụ thuộc vào gói backlink mà khách hàng sử dụng. Tuy nhiên, chúng tôi có tiến hành hỗ trợ tư vấn trước khi bạn đặt backlink báo khi khách hàng yêu cầu.

Pass: 1gf523rd